The Leading Banks in Canada

About Banking System in Canada

In Canada, financial institutions are classified into five types: chartered banks, trust and loan businesses, cooperative credit movement, life insurance firms, and securities dealers. These institutions collectively handle more than C$4.6 trillion in assets. Canada’s fundamental financial system is known across the world for its efficiency and efficacy. Some of the world’s top multinational banks now call the country home. Canada’s outstanding financial system is made possible by both prudent government policies and the efforts of devoted organisations.

Canada’s financial sector is regularly recognised and praised on a global scale. From 2007 through 2013, a prominent independent financial group rated Canada the world’s soundest banking system for six years in a row. Canadian banks are highly represented in the ranking of global financial systems. Caisse des Dépôts et Consignations, a Canadian bank, was placed 11th on Global Finance magazine’s 2019 list of the world’s safest banks. Another Canadian bank, RBC (Royal Bank of Canada), came in at number twelve.

With about 18,000 ATMs around the country, Canada ranks third only to Macau and South Korea in terms of worldwide ATM penetration. There are 220.6 ATMs per 100,000 inhabitants in Canada. This speaks to increased convenience and security for bank clients. During a visit to Canada, President Barack Obama stated that Canada’s financial system was maybe better managed than the United States’. The Canadian financial sector has been dubbed the “envy of the world” by both The Financial Times and The Guardian.

The Banking Structure of Canada

Canada has 88 banks in total, with 5,907 bank branches located around the country. The Canadian banking system is strong (regardless of the weaker government’s backing), and financial firms may be divided into five major groups —

- Chartered Banks

- The Cooperative Credit Movement

- Life Insurance Companies

- Trust and Loan Companies

- Security Dealers

There are five national banks in Canada, collectively known as the “Big Five.” They are as follows —

- Bank of Montreal

- Bank of Nova Scotia

- CIBC

- Royal Bank of Canada (RBC)

- Toronto Dominion Bank (TD)

List of the leading Canadian Banks

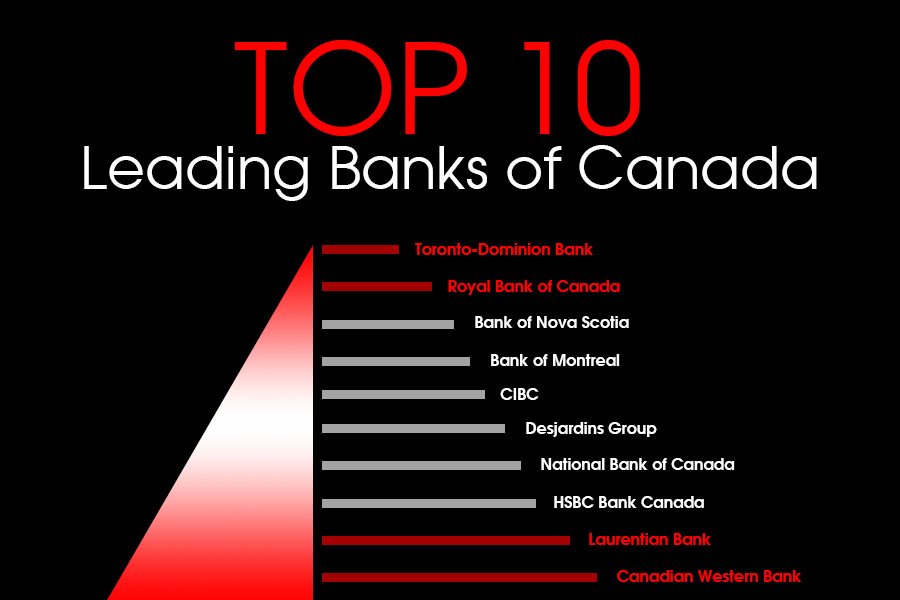

Below is the list of the Top Ten banks in Canada:

1.Toronto-Dominion Bank:

According to the 31st July 2017 report, Toronto-Dominion Bank is the largest (top-most) bank in Canada with controlling assets. Toronto-Dominion Bank has around C$1.202 trillion in assets. This bank’s net income in 2014 was C$7.7 billion, while its revenue was C$29.9 billion in the same year. It was formed in 1955, and its headquarters are located in Toronto-Dominion Centre, Toronto, Ontario. This is one of the major banks, ranking 66th on the Forbes Global 2000 in 2015.

2.Royal Bank of Canada:

In terms of total banking assets, Royal Bank of Canada is the second largest. It manages assets worth around C$1.201 trillion. It generated a net income of $8.35 billion and a sales of $35.28 billion in 2016. This bank has 78,000 employees. It is one of the oldest banks, having been founded in 1864. The corporate headquarters are in Toronto, Ontario.

3.Bank of Nova Scotia:

This is the third-largest bank in terms of total assets under management. It manages around C$906.332 billion. According to 2015 figures, it employed around 89,214 people. In 2016, it produced a net income of C$7.413 billion. In the same year, revenue was C$26.049 billion. This bank is rather ancient. It was founded in Halifax, Nova Scotia, in the year 1832. The corporate headquarters are in Toronto, Ontario.

4.Bank of Montreal:

In terms of total assets acquired, Bank of Montreal is Canada’s fourth-largest bank. It manages around C$708.617 billion in total assets and produced income of US$19.188 billion in 2016. The Bank of Montreal’s net income in the same year was US$3.455 billion. It employed around 45,234 people. It is one of Canada’s oldest banks. It was founded in 1817, about 200 years ago. The bank’s headquarters are in Montreal, Quebec.

5.CIBC:

In terms of total assets acquired, CIBC – Canadian Imperial Bank of Commerce – ranks fifth. According to the most recent report, this bank has acquired total assets of C$560.912 billion. It earned C$15 billion in sales in 2016. After deducting all expenditures, the company had a net profit of C$4.3 billion that year. There are 43,213 people working here. It was founded on June 1, 1961. CIBC’s headquarters are located in Commerce Court in Toronto, Ontario.

Also Read: Top 10 Automobile Companies in Canada

6.Desjardins Group:

Desjardins Group is not a bank, but rather one of North America’s major credit union associations. It was founded in the year 1900 in Levis, Quebec, and its headquarters are still located there. This financial organisation offers a variety of services such as checking accounts, stockbroking, insurance, asset financing, investment banking, consumer finance, and so on. There are around 47,655 individuals employed here. Desjardin Group is an Interact member that offers MasterCard and Visa credit cards. This group has purchased a total of C$271.983 in assets.

7.National Bank of Canada:

It is Canada’s seventh largest bank in terms of total assets acquired. The National Bank of Canada has purchased a total of C$240.072 billion in assets. In 2016, it earned C$5840 million in revenue and a net profit of C$1256 million. According to the most recent data on October 31, 2016, the National Bank of Canada employs 21,770 employees. It was founded in the year 1859. The company’s headquarters are in Montreal, Quebec.

8.HSBC Bank Canada:

HSBC Bank Canada has earned the eighth place in terms of total assets acquired. HSBC Bank Canada has purchased a total of C$95.810 billion in assets. As you may expect, it is a foreign subsidiary of HSBC Bank. It was formed in 1981 and has been servicing Canadian clients ever since. HSBC Bank Canada employs 6000 employees. This bank’s headquarters are in Vancouver.

9.Laurentian Bank of Canada:

This bank ranks ninth in terms of total assets acquired. Laurentian Bank of Canada has purchased a total of C$45.212 billion in assets. In 2016, this bank produced $915.5 million in revenue. This bank’s net profit in the same year was $187 million. There are 3600 individuals employed here. It was a very old bank, having been founded in 1846. The company’s headquarters are in Montreal, Quebec.

10.Canadian Western Bank:

In terms of total assets acquired, the Canadian Western Bank is ranked ninth. Canadian Western Bank has purchased a total of C$25.345 billion in assets. In 2015, the Canadian Western Bank’s sales and net income were C$579 million and $319 million, respectively. According to a 2013 estimate, around 2037 (13) people work here. It was established in 1988. The company’s headquarters are in Edmonton, Alberta.

Conclusion

The Canadian Bankers Association (CBA) was founded in 1891 and is one of the country’s oldest interest groups. It consists of a trade association and a lobbying organisation for Canadian banks. Over 60 international and domestic banks with a total of 275,000 employees operate in Canada. The CBA serves as a single point of contact for banks and banking concerns, as well as for governments and other organisations. It also strives to promote government policies that promote a healthy financial system in Canada.

Canada has had a strong economy in recent decades because to a functioning central banking system. A stable financial system attracts foreign investment and contributes to the development of a strong worldwide reputation. To take a look at the Canadian banking business in general, Canada may one day become a country known for banking and financial services, comparable to Switzerland.