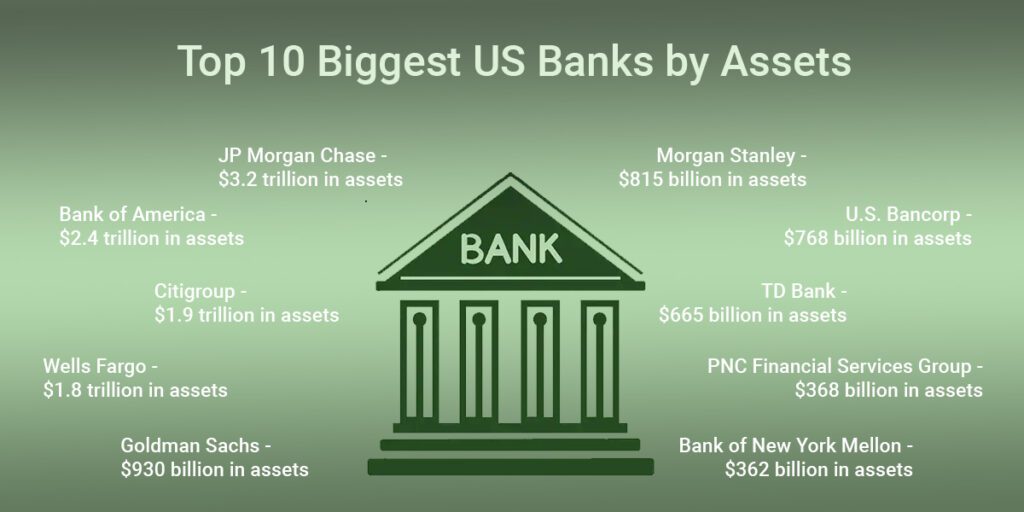

10 Biggest Banks in the USA

When talking about the largest banks in the United States, they are ranked according to assets each bank holds. In addition to this, we also indicate the number of consumers that use these banks, their branches and ATMs as a way of giving them context so for size and accessibility. The list below will help you understand which banks dominate the U.S. banking landscape and the advantages each offers over its competitors.

-

JPMorgan Chase

Assets: $3.4 trillion

Headquarters: New York City, NY

Branches: 4700+

ATMs: 16000+

Chase Bank is the consumer banking division of JPMorgan Chase & Co., headquartered in New York City; it remains America’s biggest bank by assets with a network that spans across 48 states–the greatest coverage among all banks featured here, in terms of geographical spread. It proposes various financial products such as checking accounts, savings accounts, credit cards, loans, and investment accounts.

Benefits Over Other Options

Multiple Account Options: A single stop for all financial needs.

Extensive Branch Network- Highest number of branches for easy reach.

Family-Friendly Choices- Several free accounts for children and college students.

-

Bank Of America

Assets: $2.54tn

Headquarters: Charlotte NC

Branches: 4300

ATMs: 16000

Bank of America has its headquarters in Charlotte North Carolina; it is placed second position based on total assets held by this bank. It caters to approximately sixty eight million individuals and small businesses globally through a complete range of banking services including business financing tools and investment options.

Benefits Over Other Options

Preferred Rewards Program- Staged rewards plus discounts on pricing levels.

Merrill Division – Easy reach to a large network of financial advisors.

Educational Resources – Abundant personal finance teaching materials along with e-campaigns for savings purposes online.

-

Wells Fargo

Assets: $1.73tn

Headquarters: San Francisco CA

Branches: >4500

ATMs: 13000

San Francisco-based Wells Fargo was established in 1852 and offers a wide range of financial products, from consumer banking to investment services. Despite the recent scandals, Wells Fargo still remains a major player in the US banking industry.

Benefits Over Other Options

Extensive Branch Network- The largest retail presence with over 4,500 branches.

Investment Options- DIY investment opportunities and financial advisor network.

Wide Product Range- A full array of personal bank account types, loans and credit cards.

-

Citibank

Assets: $1.68tn

Headquarters: New York City NY

Branches: 673 (U.S.), 1800+ (Global)

ATMs: 65000

Citibank is the fourth-largest bank in the United States by asset value operating under Citigroup’s consumer division. Additionally, it is recognized for its strong international footprint and competitive online banking platforms even though it has fewer physical branches compared to other major banks.

Benefits Over Other Options

Global Reach – Operations in about 150 countries worldwide.

Competitive CD Yields – Generally gives higher yields than other big banks.

Fee-Free ATM Network – Unlimited access to over 60K fee-free ATMs throughout USA.

-

U.S. Bank

Assets: $650.7 billion

Headquarters: Minneapolis, Minnesota

Branches: 2,000+

ATMs: 4,700+

U.S. Bancorp’s division, under the name U.S. Bank, is quite a strong presence in the Midwest and West with roots dating back to 1863 and it offers various financial products such as bank accounts, loans and wealth management.

Advantages Over Other Options

Midwest and Western Footprint: Strong presence with over 2,000 branches.

Low-Fee Checking Accounts: Includes benefits like the Smart Rewards program and interest-earning opportunities.

-

PNC Bank

Assets: $557.5 billion

Headquarters: Pittsburgh, Pennsylvania

Branches: 2,570+

ATMs: 9,000+

Pittsburgh-based PNC Financial Services provides many banking options that cater to students, people with disabilities or those that serve in the military among other groups along with its long list of specialty accounts. One of its innovative products is Virtual Wallet which combines checking and savings into one account.

Advantages Over Other Options

Interest-Earning Accounts: Virtual wallet offers interest on combined checking and savings accounts.

Built-In Budgeting Tools: Helps customers manage their finances effectively.

Sign-Up Bonuses: Multiple bonus options for new account holders.

-

Truist Bank

Assets: $527.5 billion

Headquarters: Charlotte, North Carolina

Branches: 2,000+

ATMs: 3,100 +

The merger of two banks BB&T and SunTrust in 2019 gave birth to Truist which is now number eight among the biggest banks in America; it serves individuals as well as businesses from the South to Mid-Atlantic regions through personal banking services commercial banking services etc.

Advantages Over Other Options

Retail Presence Over 2000 branches. No Overdraft Fees Many accounts come with perks like no overdraft fees and low or no monthly fees.

-

Goldman Sachs Bank

Assets: $521.1 billion

Headquarters: New York, New York

Branches: Online-Only

Goldman Sachs offers its online banking services through Marcus by Goldman Sachs as it majors in investment banking; although Marcus is a fully digital platform, Goldman Sachs manages to have competitive high-yield savings accounts and CDs.

Advantages Over Other Options

Investment Options Wide range of investment products for both business and consumer banking. High-Yield Accounts Competitive savings account and CD rates.

-

Capital One

Assets: $475.6 billion

Headquarters: McLean, Virginia

Branches: 400+

ATMs: 2,000 +

Capital One is a relatively new bank founded in 1994 based in McLean, VA which specializes mostly in credit cards but also provides other banking services mainly focused on the East Coast and some other regions.

Advantages Over Other Options

User-Friendly Mobile App Advanced and easy-to-use. No-Fee Credit Cards Large selection of no-fee credit card options.

-

TD Bank

Assets: $367.2 billion

Headquarters: Cherry Hill, New Jersey Branches: 1,100+

ATMs: 2,600 +

TD Bank Group has many financial products available such as mortgages, deposit accounts or credit cards through its commercial banking division called TD Bank which corresponds to the US market; for people who travel between Canada to US frequently, it can be the most convenient option given their focus on cross-border banking.

Advantages Over Other Options

Cross-Border Banking Facilitates Banking between the U.S. and Canada. Spending and Saving Tools TD MySpend app helps track your financial activities.

Pros and Cons of Large Banks

The Pros

- Reputation: The older established banks have had decades of existence and trust.

- International Banking: Many big banks have branches and networks worldwide.

- Availability of Financial Products: Offers a wide range of financial products beyond just basic banking.

- Proximity to Bank Locations for In-person Transactions: They have extensive branch locations across the country.

- Strong Web Presence: Modern online banking platforms with mobile applications available.

The Cons

- Lack of Personal Touch: Some large banks do not give the same sense of community as smaller ones.

- Possibly High Costs: The maintenance costs associated with expansive networks may necessitate higher charges on the client’s part.

- Lower Returns: Such institutions usually provide lower interest rates on savings and CDs than their counterparts, including small-sized lenders and credit unions.

Changing Landscape

This is due to mergers, acquisitions, and market changes that take place frequently within the top five banks in the US. For instance in May 2023, JPMorgan Chase bought First Republic Bank’s assets which was a significant consolidation. These occurrences are reminders that banking industry is changing over time.

In summary

These ten banks represent the largest and most influential financial institutions in the United States with each having its own advantages. If you want widespread bank branches, good yields or strong services through internet for example then chances are that one of these banks listed here could be right for you.

Also Read: